Canned Wine is Alive and Well

Every year over the last 5 or 6 years the wine writing community has launched a barrage of articles essentially claiming, “This year is . . . the year of canned wine” If you don’t believe me, just check out a few of these articles. (Forbes 2021, SevenFifty 2020, Punch 2019, MarketWatch 2018, USA Today 2017, Slate 2016).

The dramatic growth and rise of canned wine has paralleled, although on a much smaller level, the rise in Hard Seltzer and RTD (Ready to Drink) canned cocktails. Until recently, canned wine and within the beverage industry at large, canned products, were media darlings, and could do no wrong. However, recently, a number of articles published about the beginning signs of a slowdown in growth of all of these categories, question their relevancy and whether these products can continue to relate to the millennial consumer and their purchasing decisions. In one example, the Wine Industry Network’s recent article, “Is It Time to Kick the (Wine) Can?”, the editor queries whether or not the can is a passing fad. Topics raised include: canned wines’ slowing growth, consumer’s knowledge of the category, the percentage of consumers that have purchased canned wine, inability for wineries to take the product to retail and grocery market(s), and current beliefs around wine in general, including it’s health and/or environmental impact. Personally, I believe that all of the market indicators that show potential growth issues in the canned wine category, are actually positive markers pointing to overall, and eventual, higher levels of success for canned wine moving forward.

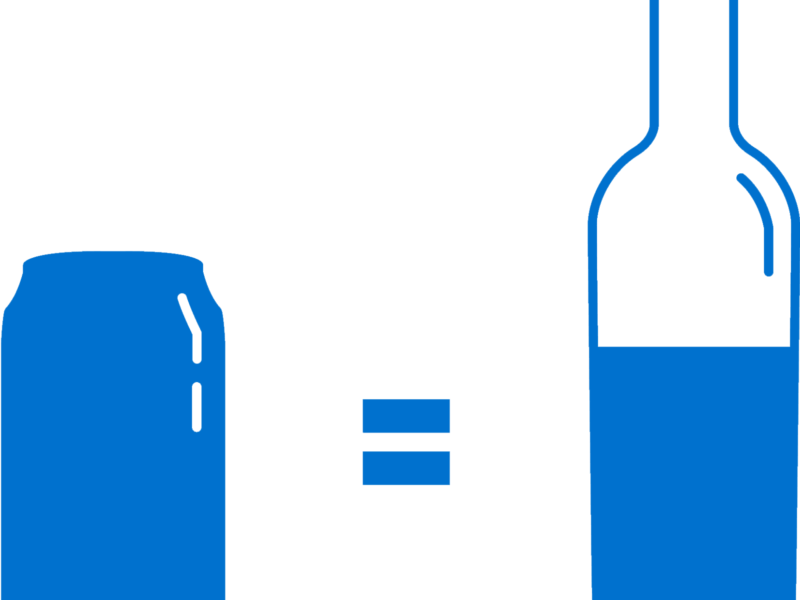

Canned wines’ impressive growth over the last 6 years has resulted in a lot of great press around the category. Which might make it difficult to believe there is a lot of room for potential. However, it currently only has a 1% share of the wine market in total. The WIN article suggests that the category’s growth is slowing, because wine consumers still aren’t aware of the category, only a small percentage of wine consumers have purchased canned wine in the past, and most wineries haven’t navigated the retail and grocery chain path of getting product to market, along with wine in general’s inherent romance and health reputation. It seems to me that all of these signs point to an opportunity for canned wine producers to take a bigger slice of the pie in the coming years.

Retail and Grocery

It’s important to remember that the wine industry is traditionally a slow moving, slow return business. Trends typically take a few years to catch on, and a planted vineyard doesn’t produce harvestable fruit for 3-5 years. Canned wines typically can go to market faster than it’s bottled counterpart, because there isn’t a necessity to age these wines in barrels for 1-2 years prior to release. As producers figure out the marketing and distribution fit for canned products, they will also realize the “no brainer” environmental, cost, and logistical benefits of the production, packaging, shipping, and quality of wine in cans. When this happens, just wait for the true floodgates to open. As more and more producers enter the category, look for retailers to allocate more and more space to canned products.

Knowledge of Canned Wine and the Percentage of Consumers That Have Purchased Canned Wine is Small

The “Beerification” of the wine industry has actually arrived, but in different ways than most people and even I, a prominent canned wine producer, could have predicted. Our recent market trips, post vaccinations, have been eye opening to the trend of alcohol beverage categories (beer, cider, wine, spirits, etc.) colliding in bigger and bigger ways. A beer made with aged Pinot Noir blended in – at a prominent gastropub, well known wineries adding cider to their bottlings, canned wines made with hops, and of course seltzers made by adding fruit juices to wine-based distillate with carbonated water are popping up all over the place. My assumption is this is just the tip of the iceberg, given I wasn’t looking for these trends but have found their presence in: Restaurants in Chicago, at the Food & Wine Classic event in Aspen, and in grocery stores in Louisiana. It’s not even as if we were hanging out at hipster locales in Coastal cities. I found these products in small shops in middle America, local grocery stores, and at fine dining establishments. The entire alcohol beverage industry is seeing changes that open up opportunities for what, when, and how products are consumed. Canned wine is a small percentage of overall consumption, but it is hardly the oddity in the marketplace it once was. Consumers have more choices now than ever before, but that just tells me they won’t be put off by the can package.

Wine’s Health Aspects

Another supposed reason for a slowdown to canned wine’s growth is that the consumer feels that all wine is healthy. This is somewhat true. We hold higher standards to the production processes for food, than we do for our alcohol. However, the notion that the “better for you” category will slow down or is slowing is false. Shanken News Daily just reported that that category is only growing and sales of that category within the wine industry have just topped 3 million cases and over $157 million dollars. Consumers want healthier, more environmentally conscious choices, they just aren’t all aware that wines can be farmed and produced in some ways that are “better” than others. I believe that as consumers learn more about canned wines’ inherent environmental and social benefits, and the fact that the can is a more stable environment than glass bottles which allows for the use of less preservatives, the consumer will begin “popping tops” more than ever. Canned wine has a messaging hurdle to jump over, rather than a lack of market fit.

I believe there are a lot of similarities to what is happening in canned wine with what happened in tech in the early 2000’s. After a number of years of growth, investment, and attention…canned products may see a period of “reset”, after which, the best ones will be bigger than ever. As the industry segments collide, there will be natural confusion and lots of short lived gambles. However, the best producers, products, and marketers will rise to the top. Most likely in unexpected ways. Consumer choices along with producers’ ability to access the market will allow for a larger share of the overall beverage market and the growth we have seen in recent years will seem small in comparison. My bet is on canned beverages 2.0. Just in case you haven’t seen it, here is a quite recent article on the many reasons to drink canned wine now from the LA Times.

-Jake